Introducing Scenario Sync (The End of the Annual Planning Theatre)

Here’s a startling reality: 4 in 5 B2B companies set their growth targets based on top-down goals, not bottom-up reality. We’ve all seen how this plays out.

Finance needs updated forecasts. Sales provides their numbers. Marketing adds their predictions. Then begins the ritual: Finance questions the assumptions. Sales defends their pipeline. Marketing argues about attribution. Everyone retreats to their corners with their spreadsheets. Three weeks later, you have a plan that’s already outdated. Meanwhile, your board wants to know why last quarter’s forecast was off by 20%.

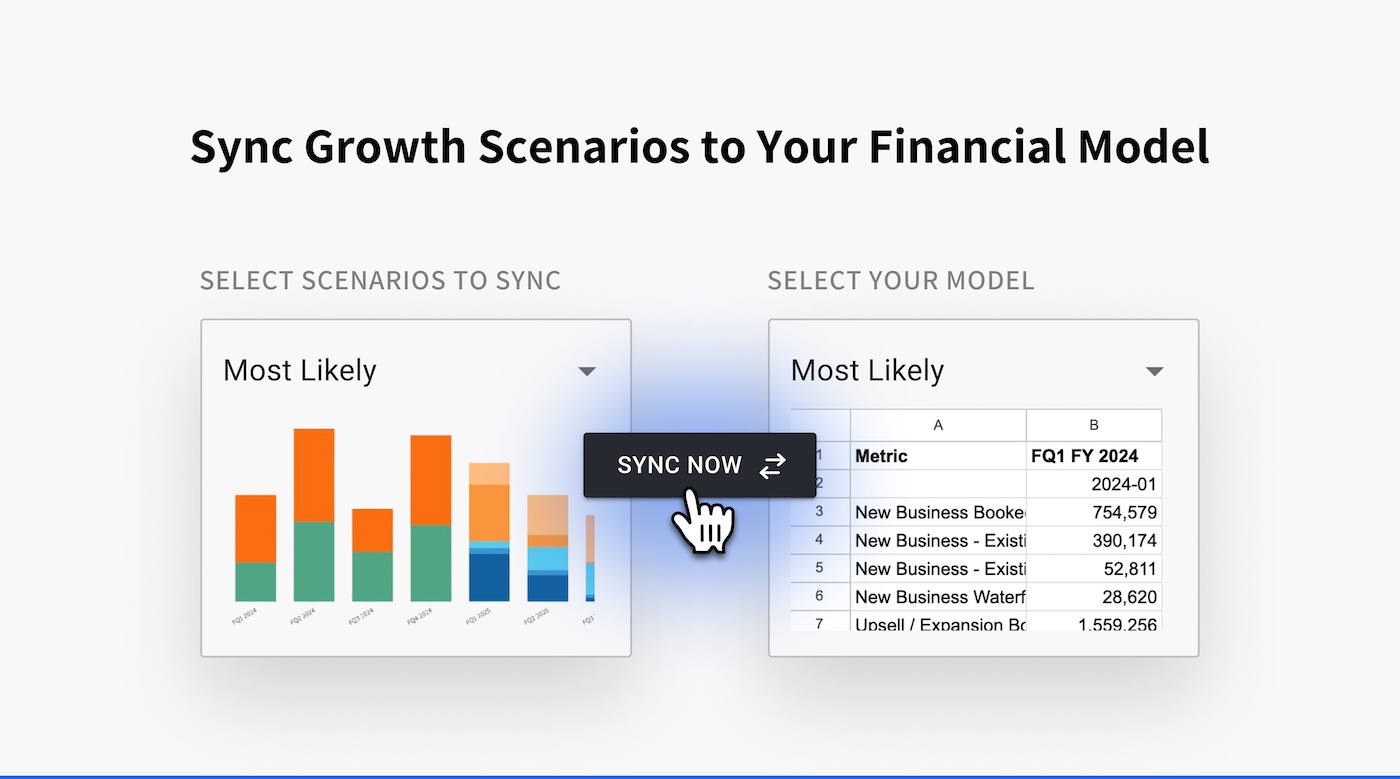

Introducing Scenario Sync

Today, we’re announcing a fundamental shift in how B2B companies align their growth planning. Scenario Sync creates intelligent connections between QFlow’s data-driven growth scenarios and your financial models. Think of it as embedding your smartest GTM Finance analyst directly into every planning conversation – but without the manual updates, assumption debates, or version control nightmares.

Scenario Sync allows Finance teams to improve their partnership with GTM teams.

How It Actually Works

Your GTM teams create and manage scenarios in QFlow – commit, target, or any other view they need. QFlow automatically assembles revenue waterfall stats, blends in timing and conversion predictions for known opportunities, and creates baseline 12-month rolling scenarios based on historical data. These scenarios sync directly to your financial model, keeping your forecasts current as reality unfolds. No more copying and pasting. No more “we’ll update it next quarter.” Just continuous, accurate forecasting that everyone trusts.

The Intelligence Layer

QFlow’s AI transforms raw pipeline data into trusted forecasts by:

- Normalizing predictions based on historical sales cycles

- Adjusting for seasonal deal size patterns

- Accounting for segment-specific conversion rates

- Weighing known pipeline probability against historical patterns

Your scenarios aren’t wishes – they’re predictions based on actual business patterns with a human in the loop.

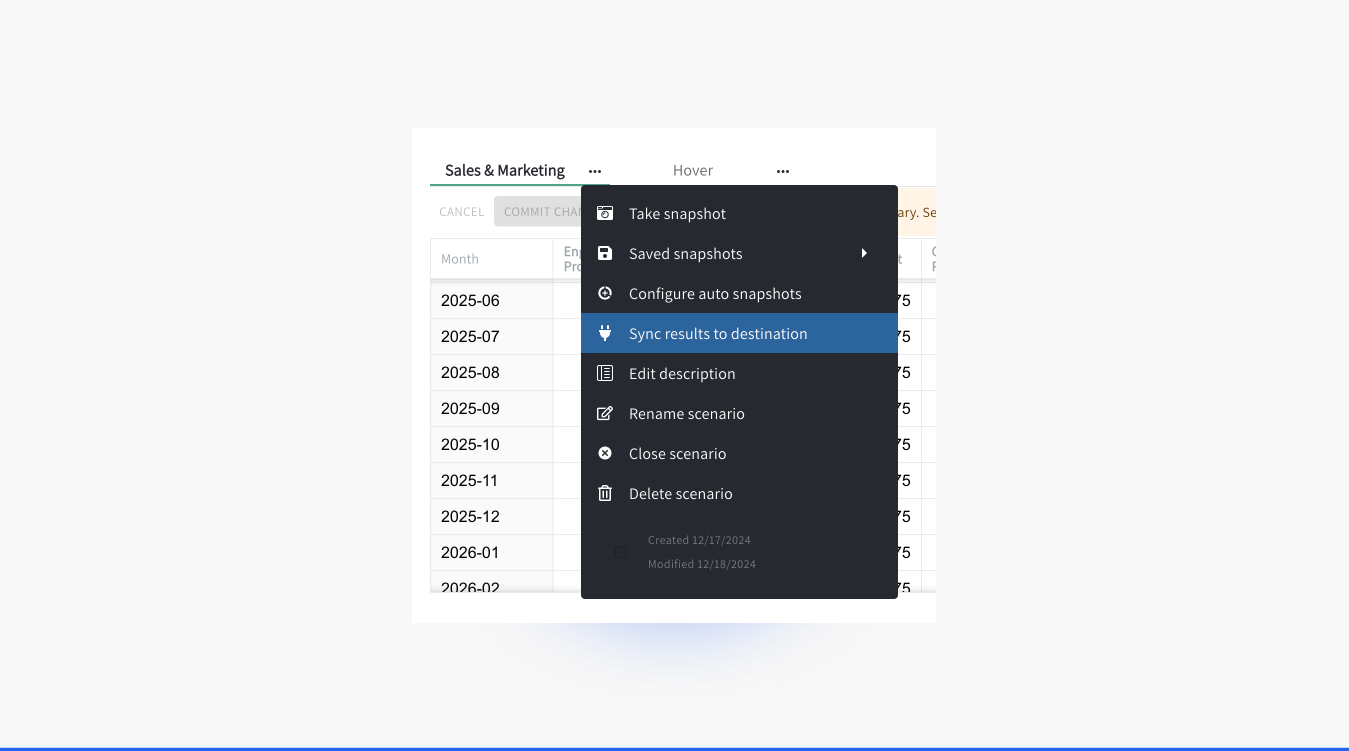

Preserving Finance Workflows

While QFlow handles prediction and analysis, your Finance team keeps working in their preferred environment. Each synced scenario creates a managed tab in your financial model containing:

- Standardized variants for sensitivity analysis

- Documented assumptions and methodologies

- Complete change history

- Direct links to source data and analysis

Real Impact on Planning

Fast-forward to your next board meeting. Instead of defending top-down targets, you’re showing bottom-up forecasts that reflect every deal, every trend, and every market shift. Your predictions aren’t just numbers – they’re stories backed by data:

- Pipeline changes reflect in real time

- Deal timing shifts update automatically

- Value fluctuations factor into forecasts immediately

- Segment performance tracks consistently

- Business type breakdowns stay current

The End of Planning Theater

Annual planning doesn’t work because business doesn’t operate annually. Growth happens continuously. Markets shift weekly. Opportunities move daily.

Scenario Sync transforms planning from an annual event into an ongoing dialogue – one based on real data, not gut feelings or outdated assumptions.

Getting Started

Scenario Sync is available in beta for Google Sheets users on QFlow’s Professional and Enterprise plans, with Excel integration in alpha testing. Setup takes minutes:

- Connect your Google account

- Navigate to scenario sync

- Select your model

- Choose scenarios to sync

Take Action

Stop letting manual updates and assumption debates derail your growth planning. Check out the demo to see how Scenario Sync can transform your forecasting process.