QFlow.ai Summer Product Updates

We’ve been rolling out updates to QFlow to help revenue teams move faster, see over the next corner and trust the numbers behind their biggest decisions.

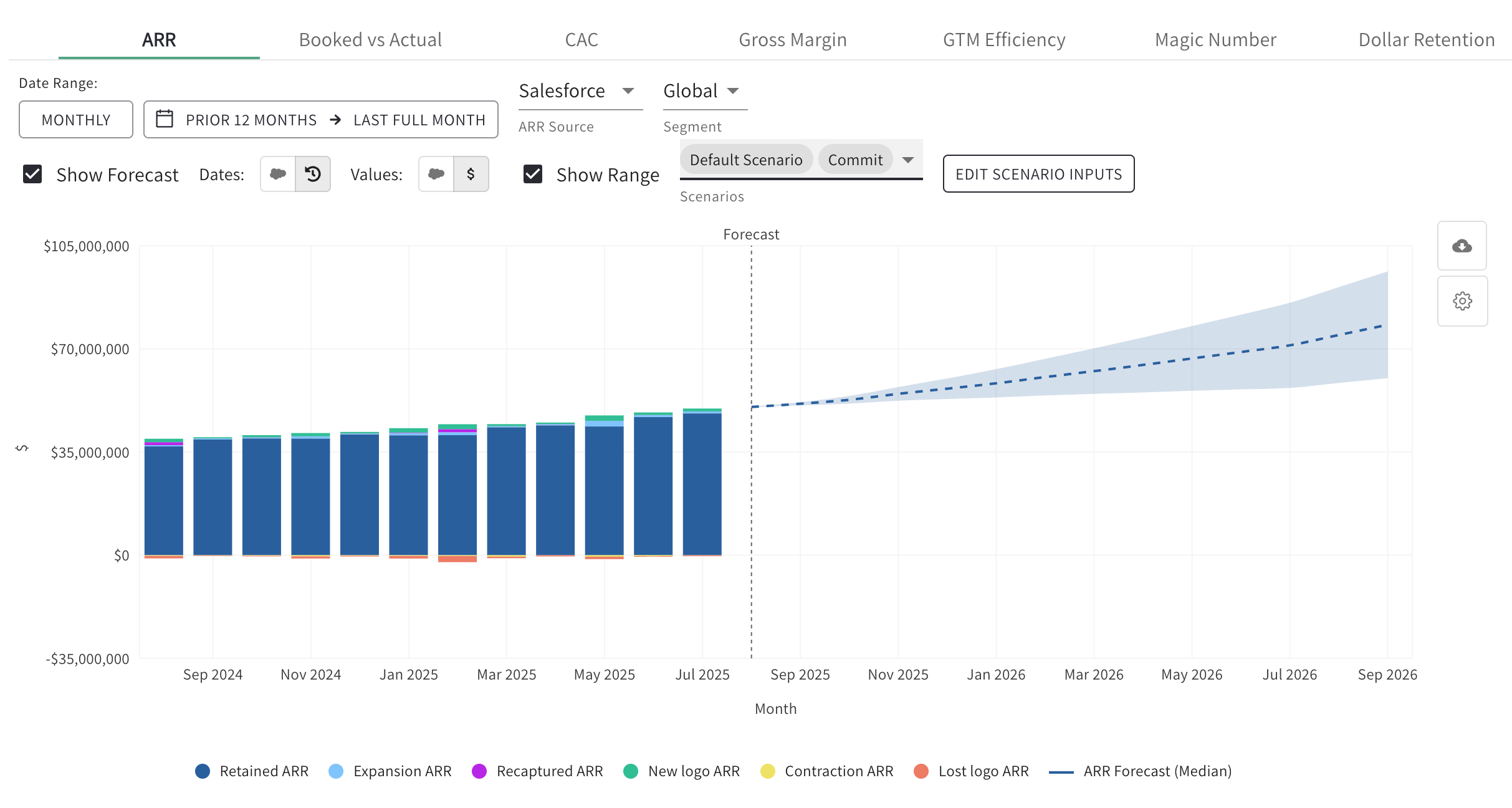

Beyond Bookings: Forecasting ARR Waterfall with Scenarios

Forecasting doesn’t stop at “what’s likely this quarter.” With our integrated Scenario Planning, you can model rolling scenarios tied directly to the ARR waterfall. Load multiple assumptions, adjust new business and renewal rates—even at the deal level—and instantly see the impact on ARR.

👉 Why it matters: This transforms the ARR waterfall from a rearview mirror into a strategic windshield. It’s faster, more dynamic, and gives leadership a range of outcomes grounded in historical data and AI likelihood scoring.

Additions to Data Hygiene: Let AI Clean, You Focus on Forecasting

Everyone knows the “garbage in, garbage out” problem. Forecasts are only as good as the data feeding them. We’ve built almost 20 always-on hygiene checks—covering everything from fuzzy account mapping to parent/child deduplication—so you can spend your time analyzing revenue drivers, not scrubbing CRM fields.

👉 Why it matters: This puts your GTM data in shape for meaningful AI analysis and scenario planning. And with Slack integration, you’ll know instantly when something needs attention.

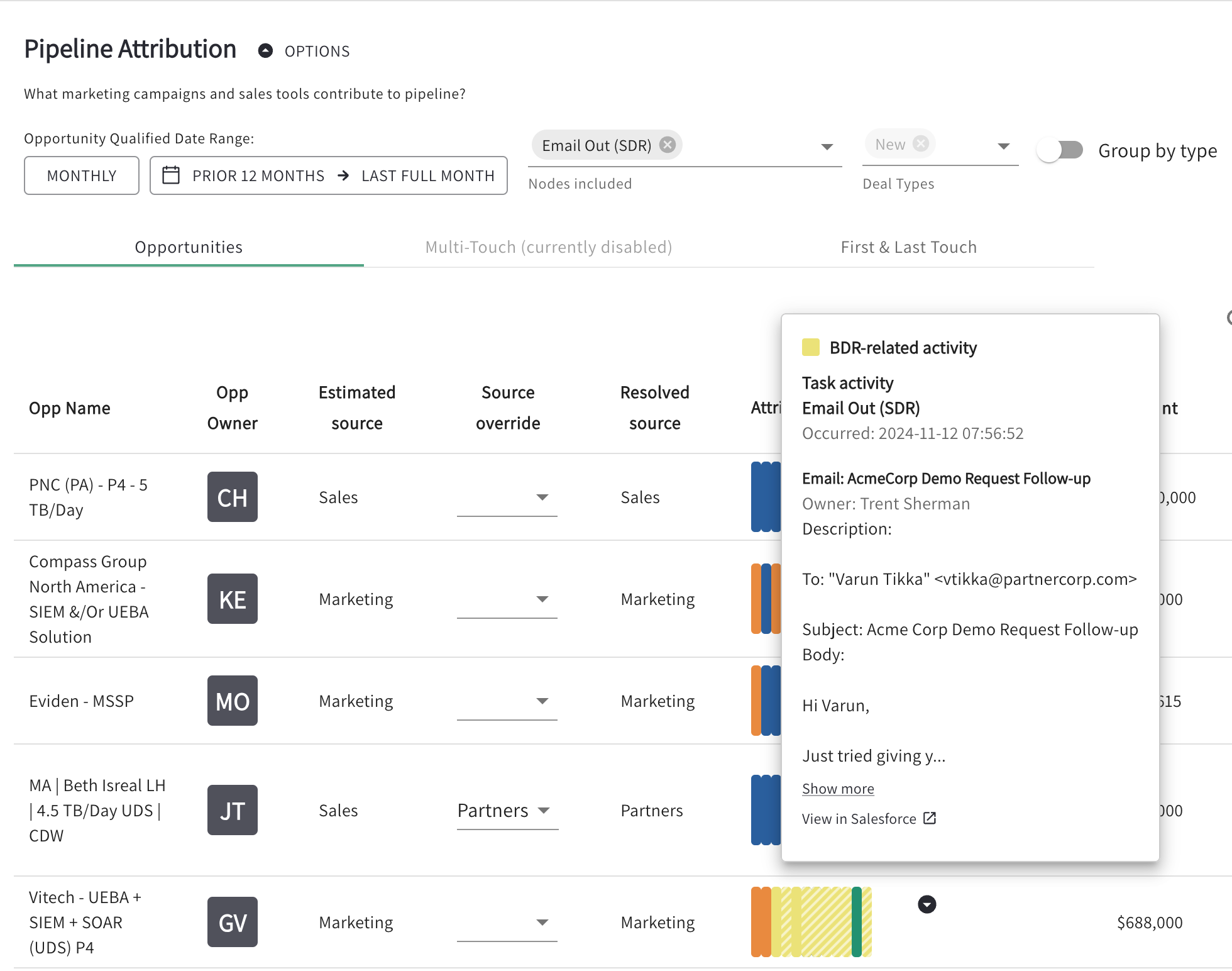

Pipeline Attribution Search: Follow the Revenue Trail

Ever wondered exactly which campaigns, channels, or activities led to the deals that closed? With Pipeline Attribution Search, you can drill into new business and cross-sell campaigns, highlight them in flow charts, and even jump directly to full account histories.

👉 Why it matters: In SaaS, pipeline attribution answers two critical questions: Where are our best deals coming from? And how should we double down? It’s the insight that makes headcount, budget, and program decisions far less of a gamble.

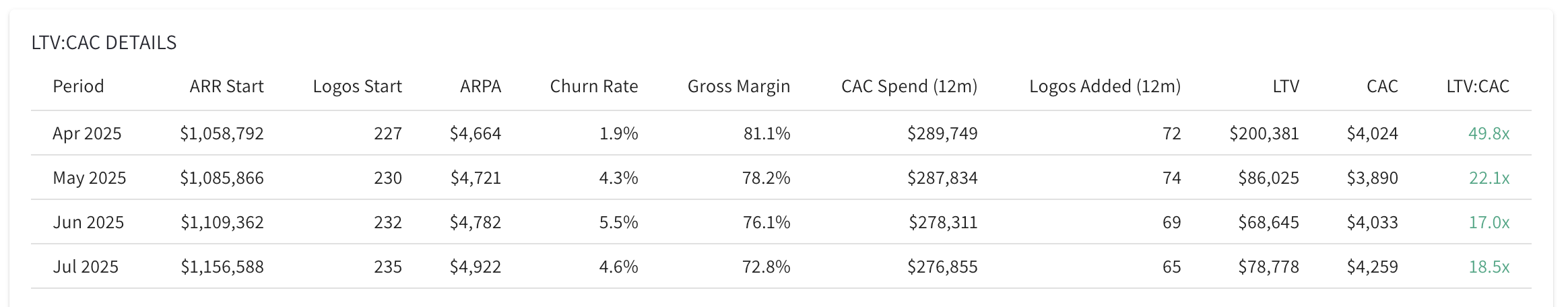

Board Stats: Speak the Language of Investors

We’ve added LTV:CAC tracking directly into the platform. Now you can measure payback periods and efficiency ratios without building custom reports.

👉 Why it matters: Whether you’re raising capital or just reporting quarterly, investors benchmark SaaS businesses on LTV:CAC. Having this data ready means you’re not just tracking revenue—you’re proving efficiency.

Win/Loss Analyzer: AI That Answers Why

Sales data tells you what happened. But rarely why. Our new Win/Loss Analyzer reviews up to 50 data points per opportunity—including Gong recordings, Salesloft activity, and emails—then applies AI research to assign win/loss reasons.

👉 Why it matters: No more relying on a single CRM field or anecdotal feedback. You get precision, consistency, and actionability—fuel to improve your playbooks and coach your teams.

QPilot: On-Demand RevOps Insights

QPilot now has access to 20+ new tools, including win rate analysis, churn modeling, sales capacity planning, and long-term growth scenarios. In short, it’s your revenue co-pilot that delivers the right data when you need it.

👉 Why it matters: Instead of static dashboards, QPilot acts like a dynamic command center, giving every GTM leader the answers they need without waiting on ops teams or analysts.

ARR Waterfall: Stop Wrestling with Spreadsheets

Tracking in-period ARR changes used to mean juggling multiple records to explain a single movement. Not anymore. With our ARR Waterfall improvements, you can now see retired vs. new ARR inside each period, grouped and surfaced in an Actual ARR Change column. Hover to trace the “expired → added” trail—perfect for board slides or audit clarity.

👉 Why it matters: Instead of wasting hours in spreadsheets, you instantly see what’s driving growth and where the risk lies. That means more time on strategy, less on cleanup.