Two Paths to GTM-Finance Alignment: Build versus Buy

Achieving alignment between your Go-to-Market (GTM) teams and Finance is no longer optional. For CFOs, Revenue Operations, and Go-to-Market leaders, the stakes are high. Without tight alignment, forecasting becomes a game of guesswork, decision-making slows to a crawl, and opportunities are lost.

The question is simple: Do you build a solution in-house or do you buy a purpose-built platform to solve the problem today?

Let’s dive into what each path really looks like.

Why GTM-Finance Alignment Is Non-Negotiable

Every GTM and Finance leader knows that when these teams aren’t aligned, it’s a recipe for chaos. GTM teams depend on real-time insights to steer strategy and course-correct quickly. Finance, on the other hand, needs to deliver rock-solid revenue forecasts that boards can count on.

Without alignment, this is what happens:

- GTM teams are left guessing, leading to inefficient resource allocation.

- Finance operates with stale assumptions, making inaccurate projections.

- Decision-making is delayed, leading to missed growth opportunities.

- The result? Missed targets, chaotic board meetings, and millions of dollars wasted.

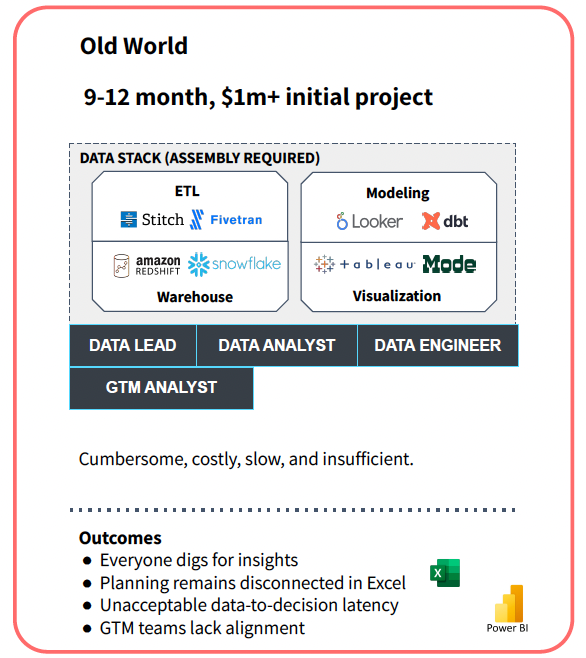

The Build Path: Going DIY on GTM-Finance Alignment

Building your own solution sounds tempting. On paper, it offers full customization, but it’s not as simple as it seems. Let’s break it down.

What Building Entails:

-

Data Stack Complexity: First, you need to assemble a robust data stack. This means stitching together ETL pipelines, data warehouses, and visualization tools. Think months of building and fine-tuning custom workflows, only to require frequent updates.

-

Forecasting and Reporting: Building accurate forecasting models requires continuous refinement. These models don’t just get set up once—they need constant tweaking based on shifting market conditions and internal dynamics.

-

Data Cleansing and Validation: Raw data is never clean. You’ll spend significant resources building pipelines that cleanse, validate, and chronologize data across both GTM and Finance, just to keep insights flowing smoothly.

-

Ongoing Maintenance: Every quarter, new processes, changes in data definitions, and GTM strategy shifts mean even more time spent reworking systems to maintain consistency and alignment across teams.

The Downsides of Building:

-

Massive Costs: A Series B company can expect to invest over $1 million in engineering, data analysts, and consultants just to get a unified solution started.

-

Slow Time-to-Value: Building this solution takes 9 to 12 months before your teams even expect to start benefiting from it.

-

Maintenance Overload: The job doesn’t end after the build. Keeping your solution current with evolving business needs will be an ongoing headache.

-

End results: Once built, executives still dig for answers, data-to-decision latency is unacceptable, and growth planning remains in spreadsheets.

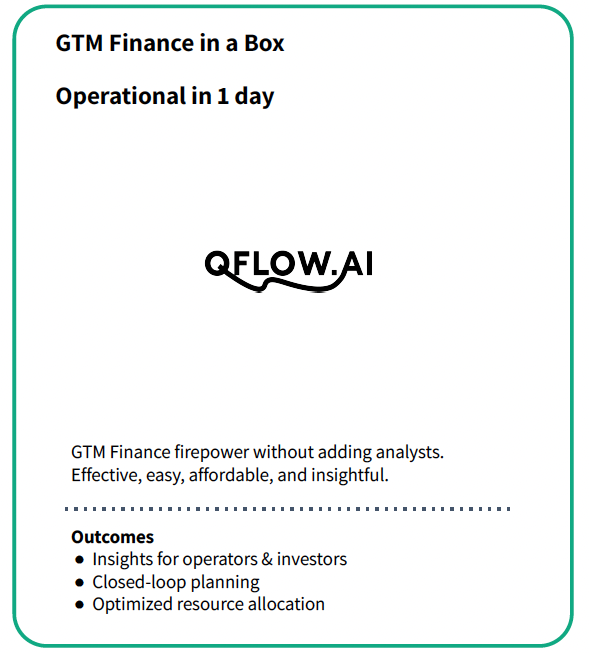

The Buy Path: Why QFlow.ai Is the Answer

Let’s get real. You can spend a year asking GTM leaders and RevOps to partner with engineers to build a solution, or you can buy a platform that already does it all—and does it better.

QFlow.ai works out-of-the-box for B2B companies to connect GTM and Finance data seamlessly. No custom development. No back-office headaches. Just results.

What Buying Entails:

-

Instant Alignment: QFlow.ai is operational in one day. Start by creating an account and connecting your CRM (required) and ERP (optional). It immediately starts syncing GTM and Finance data. Within 24 hours, you’ll be operating with insights and forecasts that otherwise take months.

-

AI-Driven Insights: Instead of relying on manual data wrangling and complex modeling, we use AI to generate accurate, real-time insights. Your teams can make decisions faster, with more confidence.

-

Focusing on what matters: Forget begging data engineers for their time or waiting on hours of analytical prep work. QFlow.ai automates everything—from scenario modeling to data validation—freeing up resources and reducing overhead.

The Benefits of Buying:

-

Speed: QFlow.ai delivers value immediately, not months from now.

-

Lower Costs: By eliminating the need for extra headcount and expensive BI tools, you slash costs and see an immediate return on investment.

-

Simplified Maintenance: Updates? Handled automatically. QFlow.ai evolves with your business without the need for constant rework.

A Real-World Example: US-based SaaS Company

Here’s how one of our clients, a SaaS company, made the switch from building to buying—and never looked back:

Before QFlow.ai:

They were managing multiple analysts, and despite having spent millions of dollars on the traditional data stack over the years, were suffering from forecast inaccuracies.

After QFlow.ai:

By implementing QFlow.ai, they started saving $280,000 annually and improved forecast accuracy to within 4%.

The True Cost of Inaction

Still not convinced? Let’s talk about the cost of doing nothing. There is nothing more important than aligning around growth.

Sticking with cost-focused FP&A tools + spreadsheets or waiting to build your own solution in a data stack comes at a price:

-

Customer Acquisition Costs (CAC) Are Unoptimized: When GTM teams and Finance aren’t aligned, resource allocation suffers. Inefficient spending on campaigns and sales resources drives up CAC, cutting into margins and stalling growth.

-

Decision Latency Equals Lost Opportunities: In today’s fast-paced market, waiting weeks for insights can kill the next two quarters. When your decision-making lags, competitors swoop in and win the opportunities you missed.

-

Manual Back-Office Work Eats Up Resources: Every process change, new assumption, or financial update requires hours of manual data entry, reconciliation, and validation. Your teams are spending more time firefighting than strategizing.

Conclusion: Build vs. Buy – It’s Not Just a Tech Decision

Building your own data solution to deliver GTM-Finance alignment may seem like the logical next step, but is it worth the millions of dollars, months of effort, and frustration once it’s “complete”? Or do you want a proven solution that delivers value from day one?

The answer is clear. Companies that grow with QFlow.ai grow smarter and grow faster.

About

QFlow is backed by K5 Tokyo Black, Precursor Ventures, and dozens of experienced operators. We are SOC 2 certified in the areas of Security, Availability, Processing Integrity, Confidentiality, and Privacy.

Let us show you a better way, risk-free. Create an account and connect a data source today.